Transferring customer information packet

Welcome to the new Paytrail!

We've compiled some basic guidelines for the mose efficient use of our payment service. Additional information can be found in our Help Center. Should you have any questions, contact us.

Klikkaa tästä suomenkieliseen versioon.

Click on a topic to go to directly to the section:

1. Service and payment methods

1. Service and payment methods

![]() Customers that have been transferred to the new Paytrail were sent an email with instructions for implementing the new Paytrail. The email was sent to the contact person for your company. If our messages have not reached you or the contact person has changed, please contact our customer service.

Customers that have been transferred to the new Paytrail were sent an email with instructions for implementing the new Paytrail. The email was sent to the contact person for your company. If our messages have not reached you or the contact person has changed, please contact our customer service.

You can find the Merchant ID and Secret key required to setup the new payment service in the Merchant account section of the new Merchant panel. Instructions for logging into the Merchant panel have been sent to your company's contact person, and the username is the email address. If the password was not saved, you can set a reset the password using the Forgot your password? link.

Replace your old Merchant ID and Merchant secret with your new Paytrail Merchant ID and Secret key in your e-commerce backend. On our website, you will also find links to platform specific installation instructions when they are available.

Payment methods

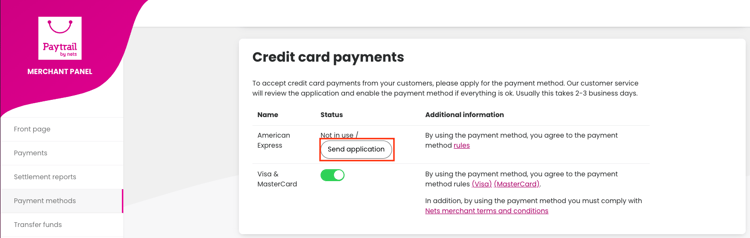

The payment methods you used in the old Paytrail will be activated for you when transferring to the new Paytrail except for American Express. Activating American Express requires adding information about the actual beneficiaries and authorized signer(s) of your company in the Merchant panel*. Once you've provided this information, you send an application in the Merchant panel:

- In the Merchant panel, click Payment methods from the menu on the left

- In the Credit card payments section, find American Express and click the Send application button

- After this, customer service will automatically process your application within a few days

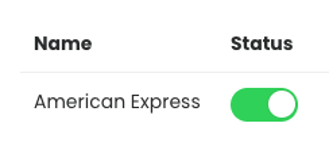

- When a payment method is activation, its status changes in the Merchant panel as shown below.

With the new Paytrail, we want to offer you as many commonly used payment methods as possible. You can verify which payment methods are available and edit your payment methods in the Merchant panel. Please note that the products/services you sell and the technical implementation of your online store may affect the range of payment methods available to you.

* Check our Help Center for more about the beneficiary information.

Below are the payment methods for the new and old Paytrail:

| Payment methods | Paytrail | New Paytrail |

| All Finnish banks | X | X |

| Cards (Visa, Mastercard, Amex **) | X | X |

| MobilePay | X | X |

| Siirto | X | X |

| Pivo | X | |

| Apple Pay | X | |

| Walley/Collector | X | X |

| Jousto | X | X |

| OP Lasku ** | X | |

| PayPal * | X |

* It is not possible to connect PayPal as a payment method to the new Paytrail payment service. If you have used the PayPal payment method on the old Paytrail side and would like to continue using it, please check with the technical implementer of your online store that PayPal can be added to your online store as a separate payment option.

** Amex and OP Lasku are not available to merchants with businesses registered outside of Finland.

Saving card information and recurring card payments

In the new Paytrail, it is possible to save the payer's credit card information for later use by tokenization. Tokenization is a secure and reliable way to store data, and allows for convenient One-Click and recurring payments. Implementing these features requires development work on the part of your online store.

2. Settlements

![]() In the new Paytrail, you will receive daily settlements as usual. Below are the key differences between the new and old Paytrail settlement models:

In the new Paytrail, you will receive daily settlements as usual. Below are the key differences between the new and old Paytrail settlement models:

In the new Paytrail, settlements are made using the 24 hour day model:

• For example, for a payment made on Monday (between 00-24), one business day will be added to the payment settlement delay, i.e. the payment will be settled on Wednesday.

• In the new Paytrail, the settlement delay is not connected to the payment method used by the customer, instead all payments have the same settlement delay.

• Payments made during the weekend will be bundled into one settlement.

In the old Paytrail, by default, settlements were made using the banking day model:

• Payment made within a business day (08-16): payment will be settled according to the settlement delay.

• Payment made outside of a business day (16-08): one business day will be added to the settlement delay.

Settlement reference number

In the new Paytrail, the settlement reference number consists of a sequential settlement number followed by a checksum. For example, if the settlement reference is 12345, the checksum is 3, so the settlement reference number is 123453.

It is also possible to set a standard reference for settlements, in this case each settlement is paid with the same reference number. The standard reference must be in the form of a national bank reference. If you have a customized reference number for settlements in the old Paytrail, please note that this information will not be transferred to the new Paytrail settlements. If you want a standard reference for settlements, please contact us.

Settlement reports

You can find the latest settlement reports on the front page of the new Merchant panel. You can also access settlement reports from the side menu by selecting Settlement reports. In the new Paytrail, the settlement report is available as soon as settlements have been calculated. A settlement overview is automatically sent to the email address specified as the recipient of the reports in the Merchant panel under Merchant account (this is only in Finnish currently). To change the recipient, you can update in the same location. You can also download a report with the monthly transactions (this report is in English). Instructions for this can be found in our Help Center.

Transaction specific details for settlement reports

In the Settlement settings in the Merchant panel, you can add a transaction specific details to your settlement report by toggling the transaction specific details on. A transaction specific list appears for those settlement reports that are generated after the setting is turned on.

Settlement reports during the transfer month

Once you switch your online store to the new Paytrail, future payments will appear in the new Merchant panel. For this reason, please download settlement reports from both the new and old Merchant panels during the transition month.

3. Refunds

Refunds are handled conveniently from the new Merchant panel. The refund amount will always be deducted from your merchant account regardless of the payment method used by the customer. Please note that there must be at least that amount in your unsettled balance in order for a refund to be made. If necessary, you can transfer additional funds in the Merchant panel for refunds (only for Finnish merchants). This allows refunds to be processed and paid to your customer as quickly as possible.

When making a refund, you can leave a comment that will be saved in the details of the refund. The payment shows the refund history, where you can view the details of an individual refund and see who made the refund if there are multiple Merchant panel users.

Detailed instructions for making refunds can be found in the Help Center.

4. New Merchant panel

![]() 1) Multiple usernames and levels in the Merchant panel

1) Multiple usernames and levels in the Merchant panel

In the Merchant panel, as an administrator, you can add multiple user accounts and assign different roles and rights to use the Merchant panel. You can grant various rights to edit data, process payments or just view data. The company administrator can create new users and manage user rights from the Merchant panel under Users.

2) Monitoring of payments

In the new Merchant panel, you can view payments for your online store from the Payments section. You can search for an individual payment using a number of different criteria, such as the customer's name (if the online store sends the customer's name to our payment service), the payment reference number or archive ID. To see all search options, click Show more.

Payment status types:

New

A payment has been created in the system but has not been paid. For example, transactions in "New" status occur when a customer goes to the payment page of your online store checkout but the customer has not progressed from there.

It is common for "New" transactions to occur that are never paid. This is normal customer behavior, where the customer changes their mind after being directed to the payment method. Payments with a "New" status will automatically transfer into "Cancelled" status within approximately two weeks if they remain unpaid.

Paid

The customer has paid for the payment and it is settled normally according to the selected settlement cycle.

Paid and settled

The customer has paid for the payment and it has been settled.

Paid, waiting for approval

A payment has been sent to your invoicing partner and is waiting processing. After processing by your invoicing partner, the status of your payment will change to either 'Paid' or 'Cancelled.'

Paid, refunded

The customer has paid for the payment and has been refunded the full amount of the payment.

Paid, partially refunded

The customer has paid for the payment and a partial refund has been made. The remaining amount can be refunded from the payment.

Cancelled

The payment transaction has been cancelled. Possible reasons for cancelation are:

- The payment has not been paid within two weeks

- The customer canceled the payment in his online bank, for example

- The payment method partner did not accept the payment, for example, the credit card did not have sufficient funds to make the payment

3) Updating information and changing payment methods

You can edit your company's information in the Merchant account section. You can also customize your payment method selection using the Status toggle in the Merchant panel under Payment methods.

4) Adding to balance for refunds

You can transfer additional funds to your merchant account for refunds using Transfer funds feature in the Merchant panel. The transfer of funds is handled as an online bank payment, and the payment is transferred to the balance of your customer funds account in real time. This requires a Finnish bank account.

5) Sending a payment link

In the Merchant panel, you can create a payment and send payment instructions, or payment link, to the customer. You can create a payment link from the Payments tab by clicking on the Create new payment button. The payment link allows you to collect payments from your customers in situations such as when the customer adds an item to their order or if the customer is unwilling or unable to use the online store.

For more information on using the Merchant panel, visit our Help Center.

5. Additional services

![]() It is possible to customize our payment service with the additional services we offer:

It is possible to customize our payment service with the additional services we offer:

Saving card information to enable recurring and One-Click payments

Saving card information is an easy and fast way to improve sales conversion on online and mobile services. At its simplest, the returning customer's payment is made with just a few clicks. In Paytrail, it is possible to save the payer's credit card information for later use by tokenization. Tokenization is a secure and reliable way to store data and allows for convenient one-click and recurring payments. Implementing these features requires development work on the part of your online store.

Additional IDs

Does your company own several online stores? Do you need payments from different products or services to be deposited in different bank accounts for accounting purposes? This is accomplished with additional IDs. Each account then has its own Merchant ID and its own Merchant panel.

With these IDs you can separate transactions, monitor growth and development, generate separate accounting reports, and have settlements to different bank accounts. The price of the additional IDs is 29,50 €/month + VAT.

Shop-in-shop service

The administrator is responsible for the technical implementation and offers merchants an effortless way to sell. Paytrail settles the money directly to the merchant that sold the products/services. The administrator is not responsible for the transaction and does not need a payment service license with the Financial Supervision Authority.

Shop-in-shop is suitable for a merchant who wants to offer others the opportunity to sell their products/services in their store or an organization that wants to direct revenue directly to an internal recipient. More information about Shop-in-Shop can be found in our Help Center.

6. Library

![]() In our library you will find Nordic E-commerce Reports, Finnish E-commerce Reports, and Web Shop Conversion Optimization Ebook. Feel free to download them from our library.

In our library you will find Nordic E-commerce Reports, Finnish E-commerce Reports, and Web Shop Conversion Optimization Ebook. Feel free to download them from our library.

How can we help?

If you need help setting up the service, get in touch. We will be happy to help!

+358 20 718 1820 - open 24/7

support@paytrail.com