How to pay with MobilePay online

MobilePay is a quick and easy way to pay using your phone.

MobilePay

MobilePay is a simple and secure mobile payment method used widely in Finland. It allows you to complete payments using your smartphone — without entering card details.

In online shops, MobilePay works through the MobilePay app, which you open and confirm with just a swipe.

There are no additional fees for using MobilePay as a consumer.

Benefits of MobilePay

- No need to enter card details

- Confirm payments quickly with a swipe

- Available for online and in-store purchases

- Popular and widely supported in Finland

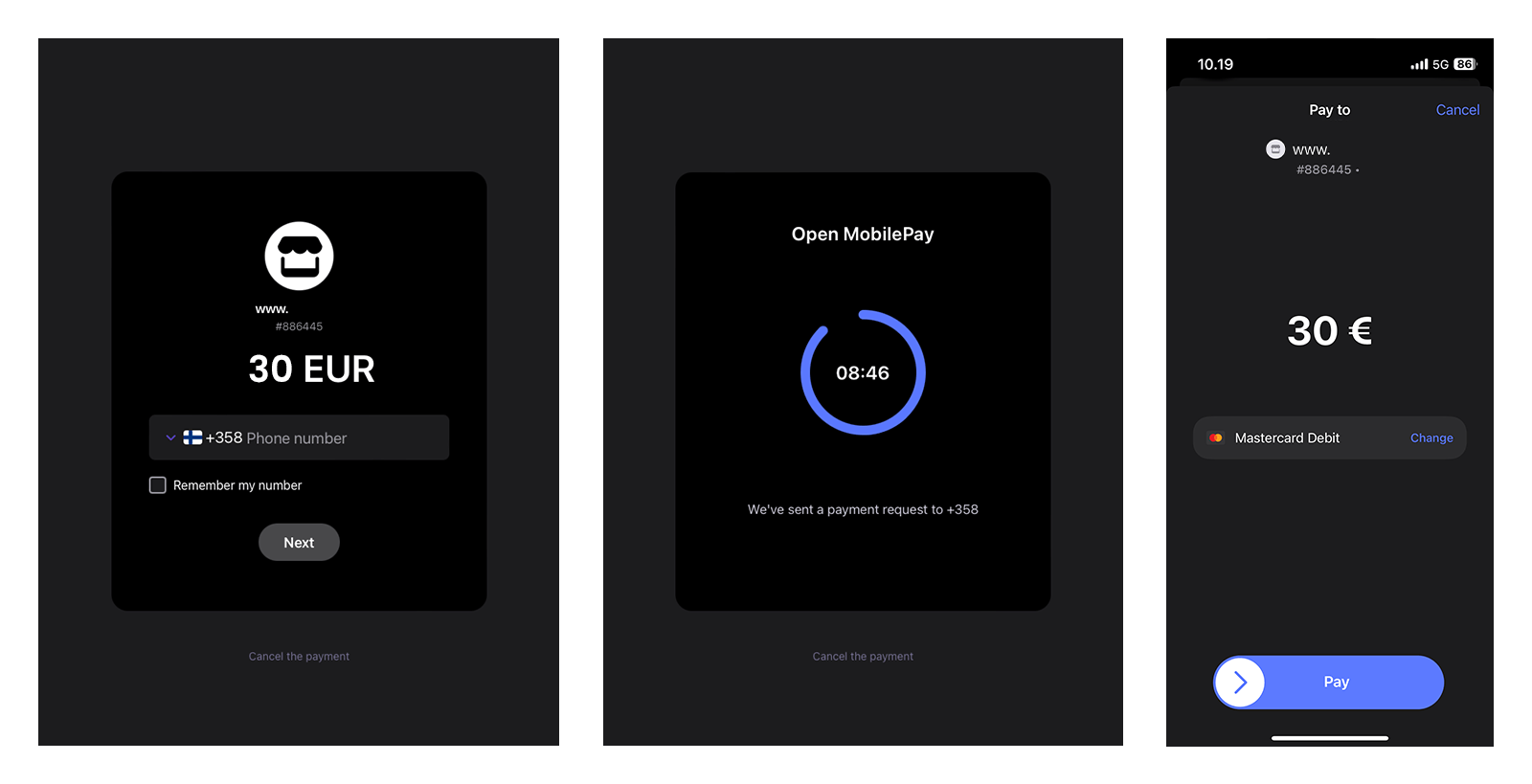

How to pay using MobilePay

- At checkout, select MobilePay as your payment method.

- Enter your phone number when prompted.

- You’ll receive a notification from the MobilePay app.

- Open the app and confirm the payment.

- Once confirmed, you’ll be automatically redirected back to the online store.